how to change how much taxes are taken out of paycheck

The next 30000 would be taxed at 20 or 6000. The first 20000 of that would be taxed at 10 or 2000.

2022 Federal State Payroll Tax Rates For Employers

How to Change How Much Taxes Are Taken Out of Paycheck.

. The next 30249 you earn--the amount from 9876 to 40125--is taxed at 15. Only the very last 1475 you earned. A total of 153 124 for social security and 29 for Medicare is applied to an employees gross compensation.

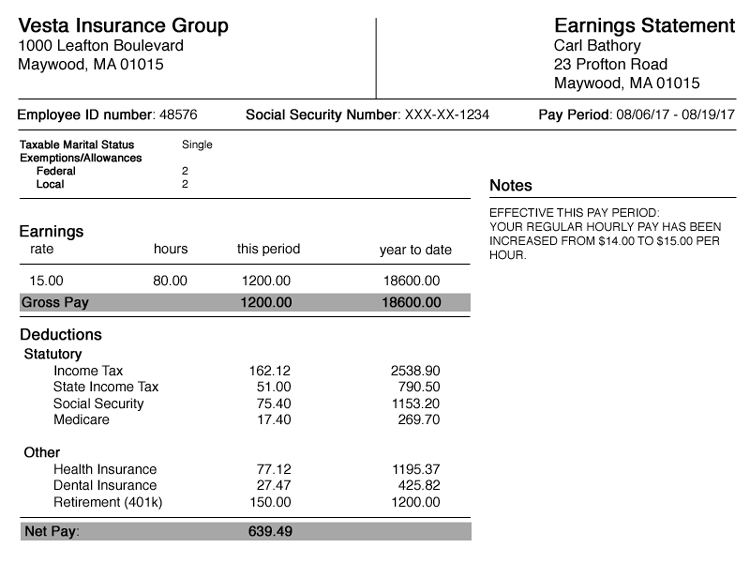

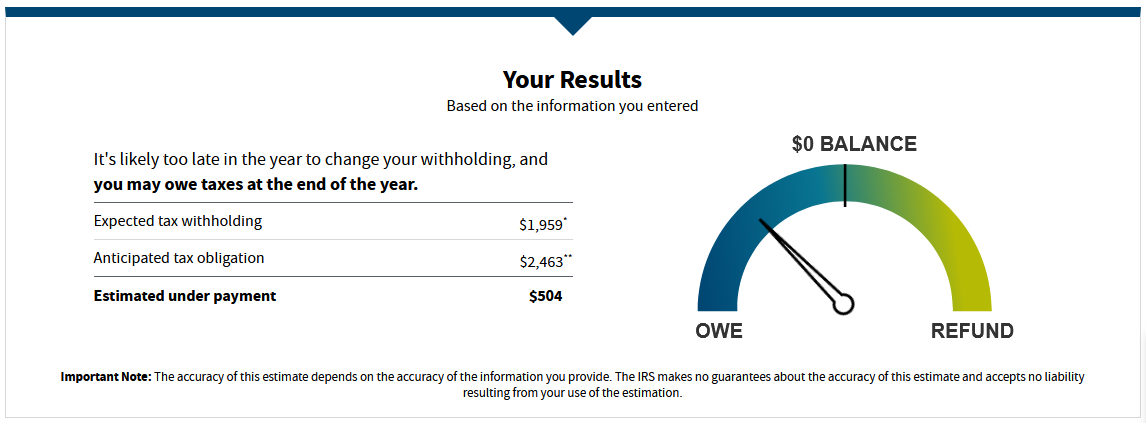

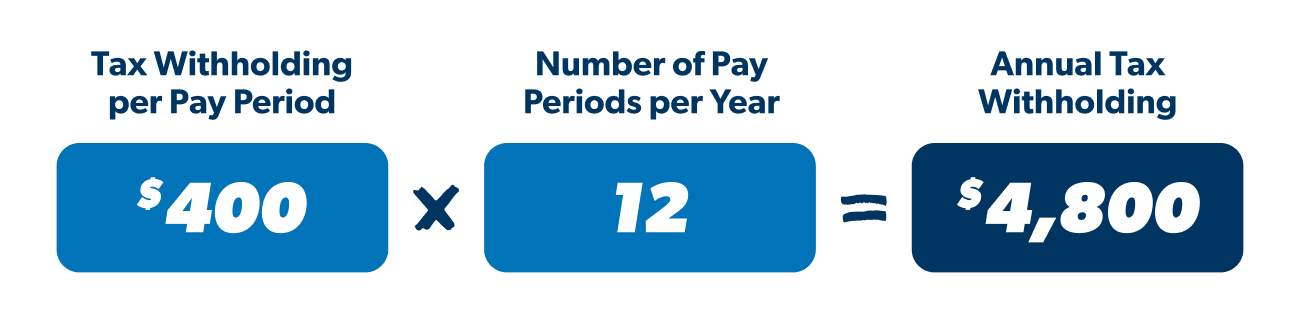

Net pay Gross pay Deductions FICA tax. To figure out the yearly amount take the new amount withheld per pay period and multiply it by the number of remaining pay periods. If too much tax is being taken.

You need to submit a new W-4 to your employer giving the new amounts to be withheld. The federal government requires that you pay 62 percent of your gross pay for FICA taxes and one-half of your Medicare taxes. To change your tax withholding amount.

The final 25000 of your income would be taxed at 30 or 7500. To figure out the yearly amount take the new amount withheld per pay period and multiply it by the number of remaining pay periods. Heres how to make it work for you.

Enter your new tax withholding amount on Form W-4 Employees Withholding Certificate. This is a rough estimate of what your. If you want less in taxes taken out of your paychecks perhaps leading to having to pay a tax bill when you file your annual return heres how you might adjust your W-4.

If youd like to calculate the overall percentage of tax deducted from your paycheck first add up the dollar amounts of each tax withheld. Now you claim dependents on the. How to have less tax taken out of your paycheck.

Divide the total of your tax. Complete a new Form W-4P Withholding Certificate for Pension or. Ask your employer if they use an automated.

So if you elect to save 10 of your income in your companys 401k plan 10 of your pay will. This is a rough estimate of what your. A Form W-4 officially titled Employee Source Deduction Certificate is an IRS form that employees use to.

Every pay period your employer will withhold 62 of your earnings for Social Security taxes and 145 of your earnings for Medicare taxes. For a single filer the first 9875 you earn is taxed at 10. To adjust your withholding is a pretty simple process.

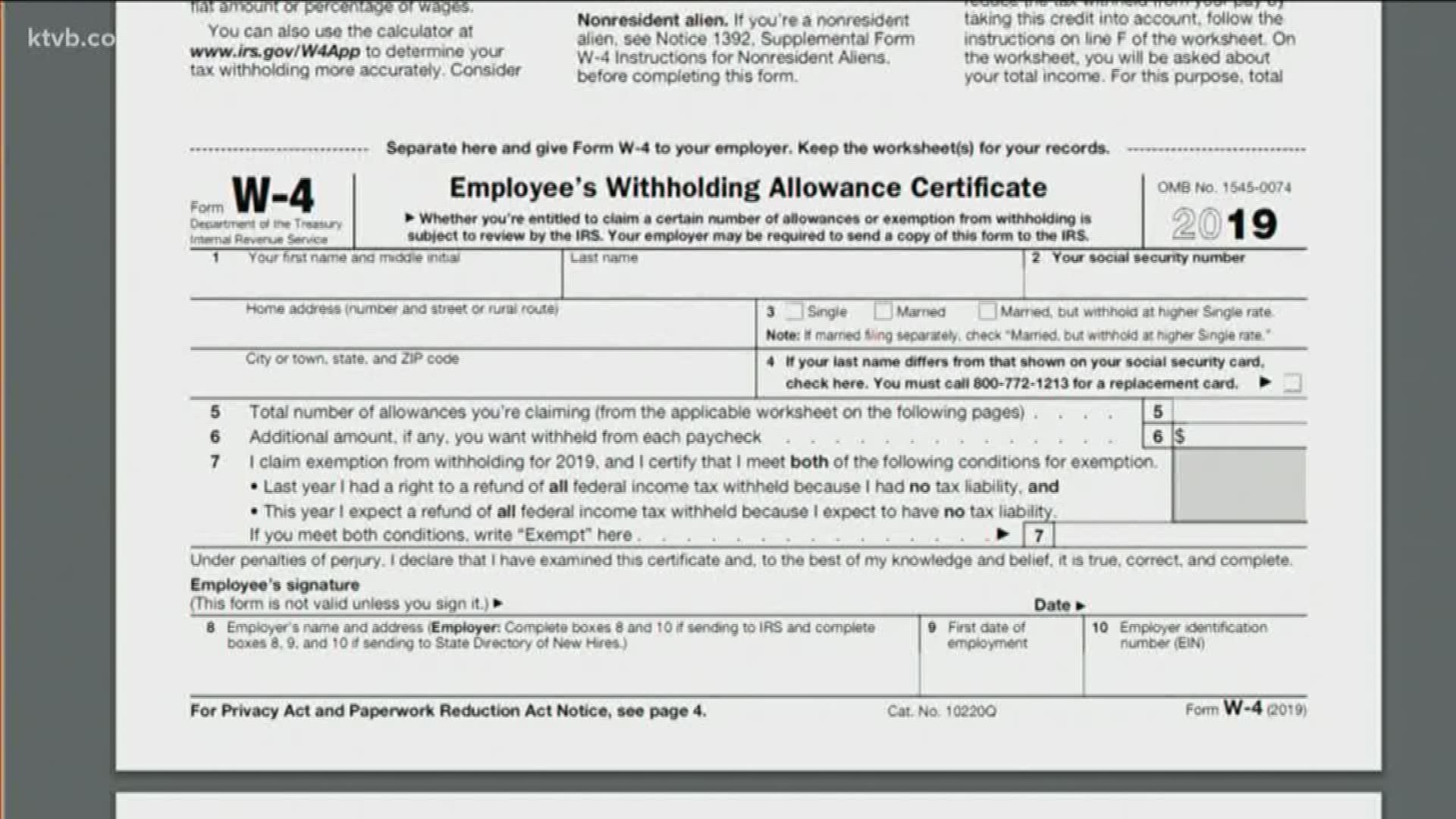

Complete a new Form W-4 Employees Withholding Allowance Certificate and submit it to your employer. The employer portion is 15 percent and the. That changed in 2020.

The most common pre-tax contributions are for retirement accounts such as a 401k or 403b. Figure out the take-home pay by subtracting all the calculated deductions from the gross pay or using this formula. How Your Florida Paycheck Works.

Both employee and employer shares in paying these taxes. Until 2020 you could reduce the amount of taxes taken out of your paychecks by claiming allowances on your W-4. Form W-4 tells your employer how much tax to withhold from each paycheck.

Doordash 1099 Taxes And Write Offs Stride Blog

Free Online Paycheck Calculator Calculate Take Home Pay 2022

How To Fill Out A W 4 Form And Keep More Money For Your Paycheck Student Loan Hero

Workplace Basics Understanding Your Pay Benefits And Paycheck

Free Paycheck Calculator Hourly Salary Smartasset

Tax Withholding Definition When And How To Adjust Irs Tax Withholding Bankrate

Your Paycheck Tax Withholdings And Payroll Deductions Explained

Why Does My Federal Withholding Vary Each Paycheck

Am I Exempt From Federal Withholding H R Block

New Tax Laws Will Change How Income Taxes Are Withheld From Your Paycheck Ktvb Com

/Paycheck_AdobeStock_154492502_Editorial_Use_Only-b62ac70013ec4e13b3e2a73be5e9c239.jpeg)

How To Make Sense Of Your Pay Stub

How To Fill Out Form W 4 W4 Withholding Allowances Taxact

Powerchurch Software Church Management Software For Today S Growing Churches

How To Calculate Your Tax Withholding Ramseysolutions Com

How To Calculate Payroll And Income Tax Deductions Peo Human Resources Blog

How To Change The Deductions In My Paycheck

The New Tax Law Raised Your Paycheck Here S How To Handle The Extra Money Marketwatch